What's happening?

We’re introducing new Multi-Factor Authentication that makes logging into your online banking more secure and user-friendly.

On internet banking, you will log in like normal with your member number and password plus you'll select your MFA as your second layer of security.

Passkeys is our recommended method, however there is the option to have a one-time text or email sent also.

What do you have to do?

You will be prompted to set up Multi-factor authentication by following the steps below.

MFA is replacing keep-safe questions and therefore is mandatory for every member to use.

Three ways to use MFA

🗝️ 1. Passkeys

Our new passkey option is the most recommended way to authenticate yourself. It’s a strong and user-friendly method to log into your mobile and internet banking.

Passkeys are an easy and safe way to sign in because it lives securely on your personal device.

NOTE: Once you set up a passkey, you won't need to set it up a second time

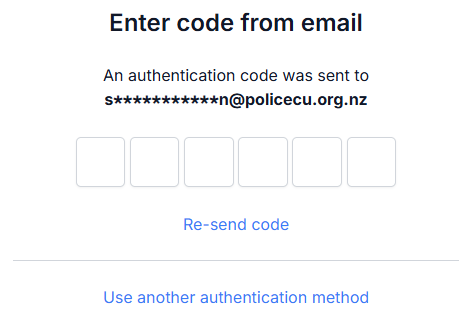

✉️ 2. Email

You'll receive a one-time password to your email address that's registered with us each time you need to authenticate yourself. This means we'll need your up-to-date email address.

📲 3. SMS

You'll be sent a one-time password to the mobile device (via SMS) registered with us. You'll need to do this each time you're prompted to authenticate, and we'll need to hold your current mobile phone number.

NOTE: Both SMS and Email forms of MFA are only one-time methods and will need to be resent each time you log in

FAQ'S

- Why didn't I receive an MFA email code?

If you haven't received an email, please check your spam email folder as it may have gone there.

Or, the email we hold on file for you could be old or incorrect. Please contact us on 0800 429 000 to update it.

- Why didn't I receive an MFA text code?

The mobile number we hold on file for you could be either old or incorrect.

Please contact us on 0800 429 000 to update it.

- Why is a passkey the best option?

It's the safest and easiest way to authenticate yourself, making it more difficult for anyone but yourself to access your account.

- What if I don't want to use MFA?

You'll need to use multi-factor authentication to access your online banking as it's the only way to safeguard your credentials.

- What if I lose my phone or device?

You can log in using a backup method using either email or text.

- What does MFA look like for IOS compared to Android?

The way MFA appears on IOS and Android phones will be different when operating MFA. But the process is the same, you will be asked to set up your pass key and a form of bio metrics.

- What if I don't get prompted to set up a passkey?

You can contact us on 0800 429 000 and we will find out why this is.

Follow these steps on your own internet banking:

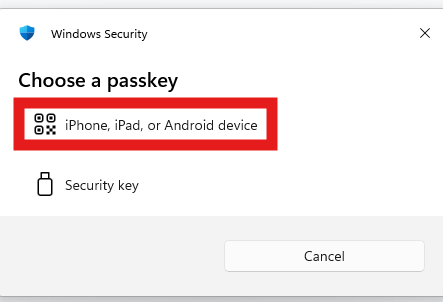

Step 1.

First time set up

To initially set up your passkey, log into your internet banking and choose 'iPhone, iPad, or Android device' as your passkey option. Ignore 'Security key'.

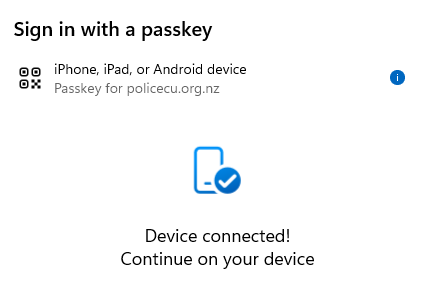

Step 2.

Enable your passkey

Scan your unique passkey once you're logged into your internet banking. (image shown is an example).

Step 3.

You're all complete

Now that your passkey is set up, next time you login, you will be prompted to select 'passkey' to confirm it's you.

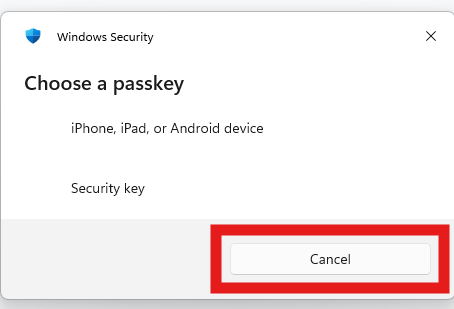

If you do not own a mobile phone or tablet

Step 1.

If you do not have a device other than your computer, you will need to go to select 'Cancel'.

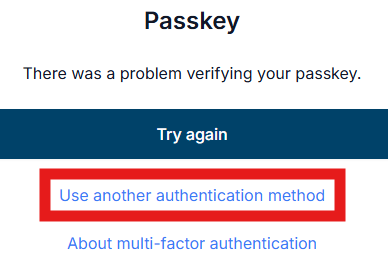

Step 2.

Select 'Use another authentication method'.

Step 3.

You will need to select 'Email OTP'.

Step 4.

Go to your emails and enter the code that was sent to you, then you're good to go!