Staying safe from scams

There’s no end to the fraudsters keen to make off with as much of your money or personal information as possible.

Some are obvious, but others are getting increasingly sophisticated, making it tricky to tell whether they’re real. Let’s cover some common scams out there with tips on how to spot fake ones.

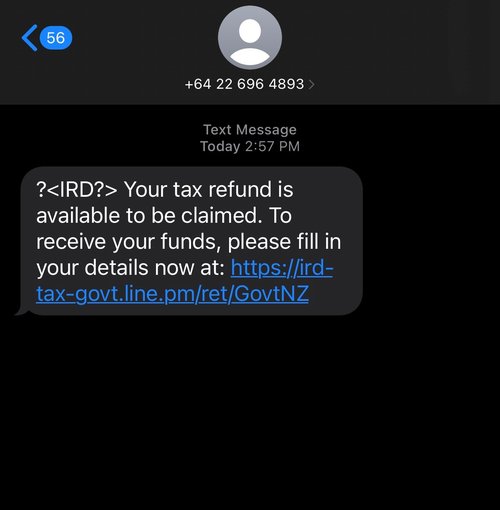

1. IRD tax refunds

A common tax-related scam (especially at this time of year) uses emails or texts pretending to be IRD advising you’re eligible for a tax refund. Some will say you’ll receive a specific amount; if they do, it’s a scam. IRD doesn’t include refund sums in their emails - scammers may use a refund amount to entice you to click their phony link and steal your info and/or your money. Even if there’s not an amount included, don't click the link. Instead, head to the IRD website separately and log in to view any legitimate letters from IRD.

You can view some of the latest tax refund scams related to IRD here.

2. Delivery redirections and fees

These scams picked up during Covid lockdowns and are still going strong. This one involves an email or text message saying it’s a delivery company (like DHL or NZ Post) and that they’ve tried to deliver a parcel to you. The message will encourage you to click a link to select a pick up time from a transit hub. You’ll then be asked to pay a small customs fee or redirection fee, but the scammers will take as much money out of your account as possible.

If you’re not expecting a parcel, it’ll be obvious that it’s a fake message! But suppose you are expecting a package and want to confirm the email or text is legitimate. In that case, you can always check your package's delivery info and status from the confirmation you received when you originally ordered.

Read more here.

3. Investing Scams

Investing scams have caused significant financial loss for many New Zealanders. The fraud will start with a cold call, email or an online advertisement promising high returns for little risk. Cert NZ shared a warning about these scams earlier this year here.

These scams can be challenging to spot due to the sophistication of the fraudsters, who use convincing websites and knowledgeable-sounding people. Do as much research and checking as possible for these.

Learn more about how to spot investment scams here so you can protect your hard-earned money.

If you think you’ve been scammed out of money from your Police Credit Union account, please call us as soon as possible on 0800 429 000.

And remember… Stay safe out there!